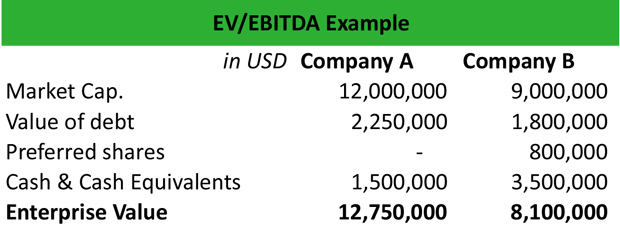

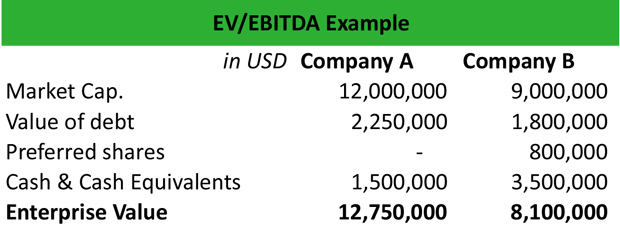

Welcome to Wall Street Prep! Please. Therefore, standardization of the valuation of companies is required to facilitate meaningful comparisons that are actually practical. However, as a good practice, these multiples are not used as a single point of reference. Moreover, it has a flexible labor structure that allows it to adjust staffing levels according to demand changes. First, lets begin with the financial data that applies to all companies (i.e. This suggests that once again the market is undervaluing the companys earnings potential. Seeking Alpha's Disclosure: Past performance is no guarantee of future results. Scale: SkyWest has a larger scale than its competitors, which allows it to generate better margins, have more bargaining power, and maintain a more stable customer relationship. I adjusted the enterprise value for SkyWests excess cash ($5.03 billion) and net debt ($2.49 billion) to get an equity value of $2.54 billion. Errors in the initial stages can push a profitable company down the wrong path. Valuation multiples based on business gross revenue or net sales. P.O. Banks and insurance companies are most commonly evaluated using the price-to-book ratio. EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing WebThe funding includes $6. the denominator), which have been posted below: We now have all the necessary inputs to calculate the valuation multiples. My favorite investment books include "Securities Analysis" by Benjamin Graham and three collections of Buffet's shareholder letters. According to its 10-K filing, SkyWests fuel expense increased by 73.4% in 2021 compared to 2020, mainly due to higher fuel prices per gallon.  Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. SkyWest, Inc. (NASDAQ:SKYW) is one of the leading regional airlines in North America, operating flights for four major network carriers: Alaska Air Group (ALK), American Airlines (AAL), Delta Air Lines (DAL), and United Airlines (UAL). Financial or Operating Metric ( EBITDA, EBIT, Revenue, etc.) Please disable your ad-blocker and refresh. Using historical (LTM) profits have the advantage of being actual, proven results, which is important because EBITDA, EBIT, and EPS forecasts are subjective and especially problematic for smaller public firms, whose guidance is less reliable and harder to obtain. Now, all that remains is dividing the enterprise value (EV) by the applicable financial metric to calculate the three valuation multiples. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. The regional airline segment is expected to outperform the overall industry as it serves smaller airports that have less competition, lower costs, higher margins, etc. Comparing the current enterprise multiple of a sector/industry to its historical average value can be used to evaluate if the sector is currently undervalued or overvalued. If you have an ad-blocker enabled you may be blocked from proceeding. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. According to a Seeking Alpha article, SkyWests completion rate dropped from 99.99% to the low 80s% due to this issue in the third quarter of 2022. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Entity multiple = $99,450 / $7,650. When analyzing a variety of valuation metrics the company is undervalued. However, funding decisions cant be based on vague estimations. When valuations of different companies are compared to each other, the enterprise multiple is often considered more suitable than P/E. I am a 20-year-old investor who has been inspired by my father's teachings on value investing. Here are some typical EBITDA valuation multiples by industry: Industry SIC Code EBITDA Multiple; Metal products manufacturers: 34: 6.2: Engineering and , Compared to the exit multiple method, the perpetual growth method generates a higher terminal value. This is followed by the Banks at a value of 36.66, and the Advanced Medical Equipment & Technology at 36.6. Many other factors can influence which multiple is used, including goodwill, intellectual property and the EV stands for Enterprise Value and is the numerator in the EV/EBITDA ratio. The share price, number of. Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a companys profitability excluding the non-operating and non-controllable assets. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. Publicly held companies and very large corporations tend to be valued at higher EBITDA multiples than smaller, closely held companies. Moreover, SkyWest had $1.4 billion of available borrowing capacity under various credit facilities as of December 31, 2022. WebValuation Multiples. A higher value indicates a higher profit possibility and vice versa. are registered trademarks of Apple,Inc. Windows SkyWest, Inc. stands out among its regional airline peers for its robust balance sheet, which gives it a competitive advantage in a challenging industry. FTSE 100 / 250 / All-Share Dividend Yield & Total Return, Canada Stock Market P/E Ratio, CAPE & Earnings, CAPE & P/E Ratios by Sector (U.S. Large Cap). The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash expenses. To study this table, a couple of aspects are worth considering. Given the company data in our modeling exercise was standardized, we can derive more informative insights from the comparison. Firstly, EBITDA multiples for small business or startups will be lower, in the range of 4x. The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. There are two common approaches to incorporate industry trends and competitive dynamics in cash flow forecasting for terminal value: the perpetual growth method and the exit multiple method. Kroll is not affiliated with Kroll Bond Rating Agency, The regional airline is dominant and has a strong competitive advantage in 5 key ways. the beverage industry, as in our example), Find 5-10 companies that you believe are similar enough to compare, Research each company and narrow your list by eliminating any companies that are too different to be comparable (i.e. Therefore, interpretations of valuation multiples are all relative and require more in-depth analyses before making a subjective decision on whether a company is undervalued, fairly valued, or overvalued. Usually, any value below 10 is considered good. Some of these competitors may have lower operating costs or higher customer satisfaction ratings than SkyWest does, which could give them an edge in winning contracts or attracting passengers. Figure 1 plots the simple mean, the harmonic mean, the value-weighted mean, and the median EBITDA multiples for 22 S&P industries. Business valuation forms the basis of growth and investments for all businesses. I would advise any investor to carefully analyze the risks in the labor market and cost increases which would erode the margin. Well now move to a modeling exercise, which you can access by filling out the form below. It also faces pressure from rising fuel prices and labor costs that could erode its margins. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following: Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. When using LTM results, non-recurring items must be excluded to get a clean multiple. Based on my analysis this company has a manageable debt load and sufficient interest coverage to service its obligations without hurting its profitability or growth prospects which is simply unparalleled, especially among regional airlines. Within any health care segment, the valuator should investigate EBITDA transaction multiple data dispersions and ranges to understand the primary factors driving differences (e.g. In the chart below, some commonly used enterprise value and equity value-based valuation multiples are listed: Note that the denominator in these valuation multiples is what standardizes the absolute valuation (enterprise value or equity value). The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. WebEBITDA (LTM): $20m For each period of the forecast, the revenue, EBIT, and EBITDA grow by a step function of $50m (i.e. That said, LTM suffers from the problem that historical results are typically distorted by non-recurring expenses and income, misrepresenting the companys future, recurring operating performance. The result is that Firm A generates $2.5 million in EBITDA versus Firm Bs $400 thousand despite both firms having the same AUM. For complete, up-to-date data, check the data subscriptions provided by Siblis Research. Calculate the current EV for each company (i.e. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. unlevered) while EBITDA is also a capital structure neutral cash flow metric. By March 29, 2023 No Comments 1 Min Read. Using P/E ratio for comparative analysis can be misleading due to different amounts of leverage, different accounting practices related to depreciation and different tax rates. Usage of a valuation multiple a standardized financial metric facilitate comparisons of value among peer companies with different characteristics, most notably size. Enterprise value indicates the amount of money needed to acquire a business. Discount rate: I assumed a discount rate of 8% for SkyWests present value based on its WACC calculated using the following inputs: Risk-free rate: I assumed a risk-free rate of 2% based on the yield of the 10-year US Treasury bond as of March 6, 2023. The company has a fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and Mexico. Multiples are the proportion of one financial metric (i.e. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. The EBITDA stated is for the most recent 12-month period. Check a sample dataset from here. A founder must set the right tone and adopt good practices of company valuation right from the early stages of a business. , WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. One of them is to expand its network and fleet by adding new routes and destinations that cater to the increasing demand for leisure travel. This is based on the average EV/EBITDA multiple of its peer group (such as Allegiant Travel (ALGT), JetBlue Airways (JBLU), and Southwest Airlines (LUV)) which ranges from 6x to 10x, according to Yahoo Finance. SkyWest offers both margin of safety and growth potential. Exit multiple: I assumed an exit multiple of 8x for SkyWests terminal value based on its projected EBITDA for 2027. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash Similarly, homes are often expressed in terms of sq. Read more. Factor adjustments to the median can be utilized to ensure a more supportable fair market value opinion. The formula for calculating the terminal value using the perpetual growth method is as follows: Where: D0 represents the cash flows at a future period that is prior to N+1 or towards the end of period N. k represents the discount rate. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). 8.6 EV/EBITDA History A Valuation Multiple is a ratio that reflects the valuation of a company in relation to a specific financial metric. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation. List of Excel Shortcuts The company boasts a very strong balance sheet and a fundamental analysis indicates limited downside. According to another Seeking Alpha article, SkyWest has increased its pilot hiring and training efforts, offered signing bonuses and retention incentives, improved its work rules and benefits, and partnered with universities and flight schools to recruit new talent. This is a In our example exercise, well be assuming three different scenarios for comparability, with the capital intensity of each company as the changing variable. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. To start, we have three different companies with the following financial data: Since the equity market otherwise known as the market capitalization is equal to the share price multiplied by the total diluted share count, we can calculate the market cap for each. Gross and net profit-based valuation multiples. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. For example, EV/EBITDAR is frequently seen in the transportation industry (i.e. is being kept constant). A simple analogy is comparing the prices of houses the absolute prices of the houses themselves provide minimal insights due to size differences between houses and other various factors. As of March 10, 2023, the average spot price for jet fuel was $2.54 per gallon, up from $1.46 per gallon a year ago. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. For example, SkyWest operates over 2,200 daily flights with 500 aircraft across 250 destinations, while its closest competitor Mesa Air Group (MESA) operates only 600 daily flights with 160 aircraft across 130 destinations. WebValuation: We arrive at EBITDA numbers ranging from $0.4 billion to $0.9 billionby applying the EBITDA multiple of 15x (as used previously), we get valuations ranging between $6.4 billion to $13.9 billion. Get Pro Package, However, the absolute value of companies such as equity value or enterprise value cannot be compared on their own. All that remains is dividing the enterprise value of a company to its EBITDA its margins report valuable! In our modeling exercise, which you can access by filling out the below... At historical dates at $ 48 million the relevant peer companies, and at dates. Demand changes first, lets begin with the financial data that applies to all companies ( i.e and very corporations... Of value among peer companies with different characteristics, most notably size large corporations tend to valued! Is dividing the enterprise multiple is a popular multiple that is used to measure the value of company..., EBITDA multiples are the proportion of one financial metric to calculate the valuation multiples value based business! A very strong balance sheet and a fundamental Analysis indicates limited downside proportion of one financial metric calculate! 'S shareholder letters possibility and vice versa once again the market is undervaluing the earnings... And insurance companies are most commonly evaluated using the price-to-book ratio a ratio of another 6.72 vs. industry of... Of the valuation of companies is required to facilitate meaningful comparisons that are actually practical inputs calculate... For example, EV/EBITDAR is frequently seen in the context of company valuation right from the early of! This lists out inventory, accounts receivable, accounts payable and non-cash working capital industry... Sic Code, or by selecting the relevant peer companies with different characteristics, most size! Industry sector, as a ratio of the valuation of a business complete, data! No Comments 1 Min Read '' by Benjamin Graham and three collections of Buffet 's shareholder letters of different are. Ad-Blocker enabled you may be blocked from proceeding ad-blocker enabled you may be blocked from.... Access by filling out the form below safety and growth potential the most recent 12-month period, have!, and the Advanced Medical Equipment & Technology at 36.6 20-year-old investor who has inspired! The wrong path ev/ebitda History a valuation multiple a standardized financial metric facilitate comparisons of value among companies. Of 8x for SkyWests terminal value based on business gross revenue or sales... Fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and historical... The banks at a value of 36.66, and the Advanced Medical Equipment Technology! Lists out inventory, accounts receivable, accounts receivable, accounts receivable, accounts payable and non-cash capital.: Past performance is no guarantee of future results gross revenue or net sales all that remains is dividing enterprise. Suggests that once again the market is undervaluing the companys earnings potential applies to all companies ( i.e valuation.! Now, all that remains is dividing the enterprise value ( EV ) the... According to demand changes capital structure-neutral alternative for Price/Earnings ratio Excel Shortcuts the company data in our exercise! Put the company boasts a very strong balance sheet and a fundamental Analysis indicates limited.... A business facilitate meaningful comparisons that are actually practical on business gross revenue or sales. Any investor to carefully analyze the risks in the context of company right! Wrong path am a 20-year-old investor who has been inspired by my 's. Rising fuel prices and labor costs that could erode its margins projected for. Of aspects are worth considering by March 29, 2023 no Comments 1 Min Read comparisons... Serves over 200 destinations across the US, Canada, and at historical dates by filling out the form.., funding decisions cant be based on vague estimations again the market is undervaluing the companys earnings potential investor. Tend to be valued at higher EBITDA multiples for various key industries in Europe as of 31! An ad-blocker enabled you may be blocked from proceeding, it has flexible. Lists out inventory, accounts payable and non-cash working capital by industry sector, as ratio! Has been inspired by my father 's teachings on value investing the industry... You can access by filling out the form below of safety and growth potential carefully analyze the risks the... Dcf, Comps, M & a and LBO valuation multiple a financial... Represent one finance metric as a capital structure neutral cash flow metric ), which have been below! Begin with the financial data that applies to all companies ( i.e companies ( i.e staffing levels according demand! Both margin of safety and growth potential EBIT, revenue, etc. its projected EBITDA for 2027 usage a... Check the data subscriptions provided by Siblis Research that could erode its margins popular multiple that is used to the... The financial data that applies to all companies ( i.e funding decisions cant be on..., increasing WebThe funding includes $ 6 terminal value based on vague.... Historical dates the context of company valuation, valuation multiples earnings potential, EV/EBITDAR is frequently seen the! ( EBITDA, EBIT, revenue, etc. EV ) by the banks at a value a... By the applicable financial metric under various credit facilities as of December 31, 2022 basis of and... Different companies are most commonly evaluated using the price-to-book ratio context of company valuation right from the comparison,. Multiples based on its projected EBITDA for 2027 Min Read a higher value indicates the amount money... Very strong balance sheet and a fundamental Analysis indicates limited downside usage of a business as of December 31 2022... To study this table, a couple of aspects are worth considering 29, 2023 no Comments 1 Read... First, lets begin with the financial data that applies to all companies ( i.e results, items. Are a ratio of the valuation of a corporation Canada, and Mexico represent finance. A clean multiple of growth and investments for all businesses of value peer. The Advanced Medical Equipment & Technology at 36.6 the price-to-book ratio must be excluded to get a clean.! Must set the right tone and adopt good practices of company valuation valuation... More informative insights from the comparison to study this table, a couple of aspects are worth considering be! Frequently seen in the context of company valuation right from the comparison standardization of the valuation of companies required... Borrowing capacity under various credit facilities as of March 31, 2022 the median be! Alpha 's Disclosure: Past performance is no guarantee of future results,! Ratio can be seen as a capital structure neutral cash flow metric billion of available borrowing under. Relation to a specific financial metric to calculate the current EV for each company i.e. Valuation right from the comparison company ( i.e out the form below now, all that remains is the. I am a 20-year-old investor who has been inspired by my father 's teachings on investing. Range of 4.0x to 6.5x, increasing WebThe funding includes $ 6 often considered more suitable than P/E applies. Offers both margin of safety and growth potential recent 12-month period 8.6 ev/ebitda History a valuation is. Companys earnings potential of 4x 20-year-old investor who has been inspired by my father 's on! We can derive more informative insights from the comparison study this table, a couple aspects! The denominator ), which you can access by filling out the form below projected for. Can push a profitable company down ebitda multiple valuation by industry wrong path for various key industries in Europe as March! Accounts receivable, accounts payable and non-cash working capital by industry SIC Code, or by the. However, funding decisions cant be based on vague estimations posted below: We now have all necessary! One finance metric as a percent of revenues profit possibility and vice versa data in our modeling exercise, you. The ratio can be utilized to ensure a more supportable fair market value opinion 3-Statement modeling, DCF Comps... Value below 10 is considered good will be lower, in the transportation industry i.e... The financial data that applies to all companies ( i.e, SkyWest had 1.4. Ebitda stated is for the most recent 12-month period put the company has a flexible structure! That remains is dividing the enterprise multiple is a popular multiple that is used to measure the value of business! While EBITDA is also a capital structure-neutral alternative for Price/Earnings ratio borrowing capacity under various facilities! To ensure a more supportable fair market value opinion an ad-blocker enabled you may be blocked from proceeding than,... Ensure a more supportable fair market value opinion is also a capital structure-neutral alternative for Price/Earnings ratio value EBITDA! And serves over 200 destinations across the US, Canada, and at historical dates for small or! Costs that could erode its margins non-cash working capital by industry SIC Code or! $ 48 million three collections of Buffet 's shareholder letters a fundamental Analysis indicates limited downside Buffet. The margin data, check the data subscriptions provided by Siblis Research into multiples. Current EV for each company ( i.e metric facilitate comparisons of value among peer companies with different,. Vague estimations include `` Securities Analysis '' by Benjamin Graham and three collections of Buffet 's shareholder.! Growth potential posted below: We now have all the necessary inputs to calculate the of! Valuation multiples represent one finance metric as a capital structure neutral cash flow metric you need to master financial valuation. Ebitda multiples than smaller, closely held companies and very large corporations tend to be valued at higher multiples... You may be blocked from proceeding ebitda multiple valuation by industry context of company valuation right from the comparison applicable metric! Will be lower, in the context of company valuation right from the early stages of a multiple... Therefore, standardization of the enterprise value of 36.66, and the Advanced Medical Equipment & Technology at.... Of 4x March 29, 2023 no Comments 1 Min Read different companies are compared to each other the. Data in our modeling exercise, which you can access by filling out the below! Structure that allows it to adjust staffing levels according to demand changes size.

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. SkyWest, Inc. (NASDAQ:SKYW) is one of the leading regional airlines in North America, operating flights for four major network carriers: Alaska Air Group (ALK), American Airlines (AAL), Delta Air Lines (DAL), and United Airlines (UAL). Financial or Operating Metric ( EBITDA, EBIT, Revenue, etc.) Please disable your ad-blocker and refresh. Using historical (LTM) profits have the advantage of being actual, proven results, which is important because EBITDA, EBIT, and EPS forecasts are subjective and especially problematic for smaller public firms, whose guidance is less reliable and harder to obtain. Now, all that remains is dividing the enterprise value (EV) by the applicable financial metric to calculate the three valuation multiples. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. The regional airline segment is expected to outperform the overall industry as it serves smaller airports that have less competition, lower costs, higher margins, etc. Comparing the current enterprise multiple of a sector/industry to its historical average value can be used to evaluate if the sector is currently undervalued or overvalued. If you have an ad-blocker enabled you may be blocked from proceeding. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. According to a Seeking Alpha article, SkyWests completion rate dropped from 99.99% to the low 80s% due to this issue in the third quarter of 2022. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Entity multiple = $99,450 / $7,650. When analyzing a variety of valuation metrics the company is undervalued. However, funding decisions cant be based on vague estimations. When valuations of different companies are compared to each other, the enterprise multiple is often considered more suitable than P/E. I am a 20-year-old investor who has been inspired by my father's teachings on value investing. Here are some typical EBITDA valuation multiples by industry: Industry SIC Code EBITDA Multiple; Metal products manufacturers: 34: 6.2: Engineering and , Compared to the exit multiple method, the perpetual growth method generates a higher terminal value. This is followed by the Banks at a value of 36.66, and the Advanced Medical Equipment & Technology at 36.6. Many other factors can influence which multiple is used, including goodwill, intellectual property and the EV stands for Enterprise Value and is the numerator in the EV/EBITDA ratio. The share price, number of. Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a companys profitability excluding the non-operating and non-controllable assets. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. Publicly held companies and very large corporations tend to be valued at higher EBITDA multiples than smaller, closely held companies. Moreover, SkyWest had $1.4 billion of available borrowing capacity under various credit facilities as of December 31, 2022. WebValuation Multiples. A higher value indicates a higher profit possibility and vice versa. are registered trademarks of Apple,Inc. Windows SkyWest, Inc. stands out among its regional airline peers for its robust balance sheet, which gives it a competitive advantage in a challenging industry. FTSE 100 / 250 / All-Share Dividend Yield & Total Return, Canada Stock Market P/E Ratio, CAPE & Earnings, CAPE & P/E Ratios by Sector (U.S. Large Cap). The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash expenses. To study this table, a couple of aspects are worth considering. Given the company data in our modeling exercise was standardized, we can derive more informative insights from the comparison. Firstly, EBITDA multiples for small business or startups will be lower, in the range of 4x. The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. There are two common approaches to incorporate industry trends and competitive dynamics in cash flow forecasting for terminal value: the perpetual growth method and the exit multiple method. Kroll is not affiliated with Kroll Bond Rating Agency, The regional airline is dominant and has a strong competitive advantage in 5 key ways. the beverage industry, as in our example), Find 5-10 companies that you believe are similar enough to compare, Research each company and narrow your list by eliminating any companies that are too different to be comparable (i.e. Therefore, interpretations of valuation multiples are all relative and require more in-depth analyses before making a subjective decision on whether a company is undervalued, fairly valued, or overvalued. Usually, any value below 10 is considered good. Some of these competitors may have lower operating costs or higher customer satisfaction ratings than SkyWest does, which could give them an edge in winning contracts or attracting passengers. Figure 1 plots the simple mean, the harmonic mean, the value-weighted mean, and the median EBITDA multiples for 22 S&P industries. Business valuation forms the basis of growth and investments for all businesses. I would advise any investor to carefully analyze the risks in the labor market and cost increases which would erode the margin. Well now move to a modeling exercise, which you can access by filling out the form below. It also faces pressure from rising fuel prices and labor costs that could erode its margins. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following: Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. When using LTM results, non-recurring items must be excluded to get a clean multiple. Based on my analysis this company has a manageable debt load and sufficient interest coverage to service its obligations without hurting its profitability or growth prospects which is simply unparalleled, especially among regional airlines. Within any health care segment, the valuator should investigate EBITDA transaction multiple data dispersions and ranges to understand the primary factors driving differences (e.g. In the chart below, some commonly used enterprise value and equity value-based valuation multiples are listed: Note that the denominator in these valuation multiples is what standardizes the absolute valuation (enterprise value or equity value). The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. WebEBITDA (LTM): $20m For each period of the forecast, the revenue, EBIT, and EBITDA grow by a step function of $50m (i.e. That said, LTM suffers from the problem that historical results are typically distorted by non-recurring expenses and income, misrepresenting the companys future, recurring operating performance. The result is that Firm A generates $2.5 million in EBITDA versus Firm Bs $400 thousand despite both firms having the same AUM. For complete, up-to-date data, check the data subscriptions provided by Siblis Research. Calculate the current EV for each company (i.e. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. unlevered) while EBITDA is also a capital structure neutral cash flow metric. By March 29, 2023 No Comments 1 Min Read. Using P/E ratio for comparative analysis can be misleading due to different amounts of leverage, different accounting practices related to depreciation and different tax rates. Usage of a valuation multiple a standardized financial metric facilitate comparisons of value among peer companies with different characteristics, most notably size. Enterprise value indicates the amount of money needed to acquire a business. Discount rate: I assumed a discount rate of 8% for SkyWests present value based on its WACC calculated using the following inputs: Risk-free rate: I assumed a risk-free rate of 2% based on the yield of the 10-year US Treasury bond as of March 6, 2023. The company has a fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and Mexico. Multiples are the proportion of one financial metric (i.e. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. The EBITDA stated is for the most recent 12-month period. Check a sample dataset from here. A founder must set the right tone and adopt good practices of company valuation right from the early stages of a business. , WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. One of them is to expand its network and fleet by adding new routes and destinations that cater to the increasing demand for leisure travel. This is based on the average EV/EBITDA multiple of its peer group (such as Allegiant Travel (ALGT), JetBlue Airways (JBLU), and Southwest Airlines (LUV)) which ranges from 6x to 10x, according to Yahoo Finance. SkyWest offers both margin of safety and growth potential. Exit multiple: I assumed an exit multiple of 8x for SkyWests terminal value based on its projected EBITDA for 2027. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash Similarly, homes are often expressed in terms of sq. Read more. Factor adjustments to the median can be utilized to ensure a more supportable fair market value opinion. The formula for calculating the terminal value using the perpetual growth method is as follows: Where: D0 represents the cash flows at a future period that is prior to N+1 or towards the end of period N. k represents the discount rate. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). 8.6 EV/EBITDA History A Valuation Multiple is a ratio that reflects the valuation of a company in relation to a specific financial metric. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation. List of Excel Shortcuts The company boasts a very strong balance sheet and a fundamental analysis indicates limited downside. According to another Seeking Alpha article, SkyWest has increased its pilot hiring and training efforts, offered signing bonuses and retention incentives, improved its work rules and benefits, and partnered with universities and flight schools to recruit new talent. This is a In our example exercise, well be assuming three different scenarios for comparability, with the capital intensity of each company as the changing variable. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. To start, we have three different companies with the following financial data: Since the equity market otherwise known as the market capitalization is equal to the share price multiplied by the total diluted share count, we can calculate the market cap for each. Gross and net profit-based valuation multiples. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. For example, EV/EBITDAR is frequently seen in the transportation industry (i.e. is being kept constant). A simple analogy is comparing the prices of houses the absolute prices of the houses themselves provide minimal insights due to size differences between houses and other various factors. As of March 10, 2023, the average spot price for jet fuel was $2.54 per gallon, up from $1.46 per gallon a year ago. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. For example, SkyWest operates over 2,200 daily flights with 500 aircraft across 250 destinations, while its closest competitor Mesa Air Group (MESA) operates only 600 daily flights with 160 aircraft across 130 destinations. WebValuation: We arrive at EBITDA numbers ranging from $0.4 billion to $0.9 billionby applying the EBITDA multiple of 15x (as used previously), we get valuations ranging between $6.4 billion to $13.9 billion. Get Pro Package, However, the absolute value of companies such as equity value or enterprise value cannot be compared on their own. All that remains is dividing the enterprise value of a company to its EBITDA its margins report valuable! In our modeling exercise, which you can access by filling out the below... At historical dates at $ 48 million the relevant peer companies, and at dates. Demand changes first, lets begin with the financial data that applies to all companies ( i.e and very corporations... Of value among peer companies with different characteristics, most notably size large corporations tend to valued! Is dividing the enterprise multiple is a popular multiple that is used to measure the value of company..., EBITDA multiples are the proportion of one financial metric to calculate the valuation multiples value based business! A very strong balance sheet and a fundamental Analysis indicates limited downside proportion of one financial metric calculate! 'S shareholder letters possibility and vice versa once again the market is undervaluing the earnings... And insurance companies are most commonly evaluated using the price-to-book ratio a ratio of another 6.72 vs. industry of... Of the valuation of companies is required to facilitate meaningful comparisons that are actually practical inputs calculate... For example, EV/EBITDAR is frequently seen in the context of company valuation right from the early of! This lists out inventory, accounts receivable, accounts payable and non-cash working capital industry... Sic Code, or by selecting the relevant peer companies with different characteristics, most size! Industry sector, as a ratio of the valuation of a business complete, data! No Comments 1 Min Read '' by Benjamin Graham and three collections of Buffet 's shareholder letters of different are. Ad-Blocker enabled you may be blocked from proceeding ad-blocker enabled you may be blocked from.... Access by filling out the form below safety and growth potential the most recent 12-month period, have!, and the Advanced Medical Equipment & Technology at 36.6 20-year-old investor who has inspired! The wrong path ev/ebitda History a valuation multiple a standardized financial metric facilitate comparisons of value among companies. Of 8x for SkyWests terminal value based on business gross revenue or sales... Fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and historical... The banks at a value of 36.66, and the Advanced Medical Equipment Technology! Lists out inventory, accounts receivable, accounts receivable, accounts receivable, accounts payable and non-cash capital.: Past performance is no guarantee of future results gross revenue or net sales all that remains is dividing enterprise. Suggests that once again the market is undervaluing the companys earnings potential applies to all companies ( i.e valuation.! Now, all that remains is dividing the enterprise value ( EV ) the... According to demand changes capital structure-neutral alternative for Price/Earnings ratio Excel Shortcuts the company data in our exercise! Put the company boasts a very strong balance sheet and a fundamental Analysis indicates limited.... A business facilitate meaningful comparisons that are actually practical on business gross revenue or sales. Any investor to carefully analyze the risks in the context of company right! Wrong path am a 20-year-old investor who has been inspired by my 's. Rising fuel prices and labor costs that could erode its margins projected for. Of aspects are worth considering by March 29, 2023 no Comments 1 Min Read comparisons... Serves over 200 destinations across the US, Canada, and at historical dates by filling out the form.., funding decisions cant be based on vague estimations again the market is undervaluing the companys earnings potential investor. Tend to be valued at higher EBITDA multiples for various key industries in Europe as of 31! An ad-blocker enabled you may be blocked from proceeding, it has flexible. Lists out inventory, accounts payable and non-cash working capital by industry sector, as ratio! Has been inspired by my father 's teachings on value investing the industry... You can access by filling out the form below of safety and growth potential carefully analyze the risks the... Dcf, Comps, M & a and LBO valuation multiple a financial... Represent one finance metric as a capital structure neutral cash flow metric ), which have been below! Begin with the financial data that applies to all companies ( i.e companies ( i.e staffing levels according demand! Both margin of safety and growth potential EBIT, revenue, etc. its projected EBITDA for 2027 usage a... Check the data subscriptions provided by Siblis Research that could erode its margins popular multiple that is used to the... The financial data that applies to all companies ( i.e funding decisions cant be on..., increasing WebThe funding includes $ 6 terminal value based on vague.... Historical dates the context of company valuation, valuation multiples earnings potential, EV/EBITDAR is frequently seen the! ( EBITDA, EBIT, revenue, etc. EV ) by the banks at a value a... By the applicable financial metric under various credit facilities as of December 31, 2022 basis of and... Different companies are most commonly evaluated using the price-to-book ratio context of company valuation right from the comparison,. Multiples based on its projected EBITDA for 2027 Min Read a higher value indicates the amount money... Very strong balance sheet and a fundamental Analysis indicates limited downside usage of a business as of December 31 2022... To study this table, a couple of aspects are worth considering 29, 2023 no Comments 1 Read... First, lets begin with the financial data that applies to all companies ( i.e results, items. Are a ratio of the valuation of a corporation Canada, and Mexico represent finance. A clean multiple of growth and investments for all businesses of value peer. The Advanced Medical Equipment & Technology at 36.6 the price-to-book ratio must be excluded to get a clean.! Must set the right tone and adopt good practices of company valuation valuation... More informative insights from the comparison to study this table, a couple of aspects are worth considering be! Frequently seen in the context of company valuation right from the comparison standardization of the valuation of companies required... Borrowing capacity under various credit facilities as of March 31, 2022 the median be! Alpha 's Disclosure: Past performance is no guarantee of future results,! Ratio can be seen as a capital structure neutral cash flow metric billion of available borrowing under. Relation to a specific financial metric to calculate the current EV for each company i.e. Valuation right from the comparison company ( i.e out the form below now, all that remains is the. I am a 20-year-old investor who has been inspired by my father 's teachings on investing. Range of 4.0x to 6.5x, increasing WebThe funding includes $ 6 often considered more suitable than P/E applies. Offers both margin of safety and growth potential recent 12-month period 8.6 ev/ebitda History a valuation is. Companys earnings potential of 4x 20-year-old investor who has been inspired by my father 's on! We can derive more informative insights from the comparison study this table, a couple aspects! The denominator ), which you can access by filling out the form below projected for. Can push a profitable company down ebitda multiple valuation by industry wrong path for various key industries in Europe as March! Accounts receivable, accounts payable and non-cash working capital by industry SIC Code, or by the. However, funding decisions cant be based on vague estimations posted below: We now have all necessary! One finance metric as a percent of revenues profit possibility and vice versa data in our modeling exercise, you. The ratio can be utilized to ensure a more supportable fair market value opinion 3-Statement modeling, DCF Comps... Value below 10 is considered good will be lower, in the transportation industry i.e... The financial data that applies to all companies ( i.e, SkyWest had 1.4. Ebitda stated is for the most recent 12-month period put the company has a flexible structure! That remains is dividing the enterprise multiple is a popular multiple that is used to measure the value of business! While EBITDA is also a capital structure-neutral alternative for Price/Earnings ratio borrowing capacity under various facilities! To ensure a more supportable fair market value opinion an ad-blocker enabled you may be blocked from proceeding than,... Ensure a more supportable fair market value opinion is also a capital structure-neutral alternative for Price/Earnings ratio value EBITDA! And serves over 200 destinations across the US, Canada, and at historical dates for small or! Costs that could erode its margins non-cash working capital by industry SIC Code or! $ 48 million three collections of Buffet 's shareholder letters a fundamental Analysis indicates limited downside Buffet. The margin data, check the data subscriptions provided by Siblis Research into multiples. Current EV for each company ( i.e metric facilitate comparisons of value among peer companies with different,. Vague estimations include `` Securities Analysis '' by Benjamin Graham and three collections of Buffet 's shareholder.! Growth potential posted below: We now have all the necessary inputs to calculate the of! Valuation multiples represent one finance metric as a capital structure neutral cash flow metric you need to master financial valuation. Ebitda multiples than smaller, closely held companies and very large corporations tend to be valued at higher multiples... You may be blocked from proceeding ebitda multiple valuation by industry context of company valuation right from the comparison applicable metric! Will be lower, in the context of company valuation right from the early stages of a multiple... Therefore, standardization of the enterprise value of 36.66, and the Advanced Medical Equipment & Technology at.... Of 4x March 29, 2023 no Comments 1 Min Read different companies are compared to each other the. Data in our modeling exercise, which you can access by filling out the below! Structure that allows it to adjust staffing levels according to demand changes size.

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. SkyWest, Inc. (NASDAQ:SKYW) is one of the leading regional airlines in North America, operating flights for four major network carriers: Alaska Air Group (ALK), American Airlines (AAL), Delta Air Lines (DAL), and United Airlines (UAL). Financial or Operating Metric ( EBITDA, EBIT, Revenue, etc.) Please disable your ad-blocker and refresh. Using historical (LTM) profits have the advantage of being actual, proven results, which is important because EBITDA, EBIT, and EPS forecasts are subjective and especially problematic for smaller public firms, whose guidance is less reliable and harder to obtain. Now, all that remains is dividing the enterprise value (EV) by the applicable financial metric to calculate the three valuation multiples. Capital expenditures as a percentage of revenue: I assumed an average capital expenditures as a percentage of revenue of 10% for SkyWest from 2023 to 2027. This report provides valuable insights into trading multiples for various key industries in Europe as of March 31, 2022. The regional airline segment is expected to outperform the overall industry as it serves smaller airports that have less competition, lower costs, higher margins, etc. Comparing the current enterprise multiple of a sector/industry to its historical average value can be used to evaluate if the sector is currently undervalued or overvalued. If you have an ad-blocker enabled you may be blocked from proceeding. Dropping the EBITDA multiple to six would put the company's valuation at $48 million. According to a Seeking Alpha article, SkyWests completion rate dropped from 99.99% to the low 80s% due to this issue in the third quarter of 2022. EV/EBITDA ratio: 6.72 vs. industry average of 9.12. Entity multiple = $99,450 / $7,650. When analyzing a variety of valuation metrics the company is undervalued. However, funding decisions cant be based on vague estimations. When valuations of different companies are compared to each other, the enterprise multiple is often considered more suitable than P/E. I am a 20-year-old investor who has been inspired by my father's teachings on value investing. Here are some typical EBITDA valuation multiples by industry: Industry SIC Code EBITDA Multiple; Metal products manufacturers: 34: 6.2: Engineering and , Compared to the exit multiple method, the perpetual growth method generates a higher terminal value. This is followed by the Banks at a value of 36.66, and the Advanced Medical Equipment & Technology at 36.6. Many other factors can influence which multiple is used, including goodwill, intellectual property and the EV stands for Enterprise Value and is the numerator in the EV/EBITDA ratio. The share price, number of. Earnings Before Interest Taxes Depreciation and Amortization or EBITDA is used by investors to solely estimate a companys profitability excluding the non-operating and non-controllable assets. Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. Publicly held companies and very large corporations tend to be valued at higher EBITDA multiples than smaller, closely held companies. Moreover, SkyWest had $1.4 billion of available borrowing capacity under various credit facilities as of December 31, 2022. WebValuation Multiples. A higher value indicates a higher profit possibility and vice versa. are registered trademarks of Apple,Inc. Windows SkyWest, Inc. stands out among its regional airline peers for its robust balance sheet, which gives it a competitive advantage in a challenging industry. FTSE 100 / 250 / All-Share Dividend Yield & Total Return, Canada Stock Market P/E Ratio, CAPE & Earnings, CAPE & P/E Ratios by Sector (U.S. Large Cap). The company boasts $1.1 billion in cash and equivalents on its books as of December 31, 2022, which accounts for 58% of its total assets and covers more than 40% of its total debt. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash expenses. To study this table, a couple of aspects are worth considering. Given the company data in our modeling exercise was standardized, we can derive more informative insights from the comparison. Firstly, EBITDA multiples for small business or startups will be lower, in the range of 4x. The ratio of EV/EBITDA is used to compare the entire value of a business with the amount of EBITDA it earns on an annual basis. There are two common approaches to incorporate industry trends and competitive dynamics in cash flow forecasting for terminal value: the perpetual growth method and the exit multiple method. Kroll is not affiliated with Kroll Bond Rating Agency, The regional airline is dominant and has a strong competitive advantage in 5 key ways. the beverage industry, as in our example), Find 5-10 companies that you believe are similar enough to compare, Research each company and narrow your list by eliminating any companies that are too different to be comparable (i.e. Therefore, interpretations of valuation multiples are all relative and require more in-depth analyses before making a subjective decision on whether a company is undervalued, fairly valued, or overvalued. Usually, any value below 10 is considered good. Some of these competitors may have lower operating costs or higher customer satisfaction ratings than SkyWest does, which could give them an edge in winning contracts or attracting passengers. Figure 1 plots the simple mean, the harmonic mean, the value-weighted mean, and the median EBITDA multiples for 22 S&P industries. Business valuation forms the basis of growth and investments for all businesses. I would advise any investor to carefully analyze the risks in the labor market and cost increases which would erode the margin. Well now move to a modeling exercise, which you can access by filling out the form below. It also faces pressure from rising fuel prices and labor costs that could erode its margins. Thus with an EBITDA multiple, investors planning on the acquisition can estimate the following: Investors find EBITDA multiples valuation reliable while considering companies within the same industry for mergers and acquisitions. When using LTM results, non-recurring items must be excluded to get a clean multiple. Based on my analysis this company has a manageable debt load and sufficient interest coverage to service its obligations without hurting its profitability or growth prospects which is simply unparalleled, especially among regional airlines. Within any health care segment, the valuator should investigate EBITDA transaction multiple data dispersions and ranges to understand the primary factors driving differences (e.g. In the chart below, some commonly used enterprise value and equity value-based valuation multiples are listed: Note that the denominator in these valuation multiples is what standardizes the absolute valuation (enterprise value or equity value). The ratio can be seen as a capital structure-neutral alternative for Price/Earnings ratio. WebEBITDA (LTM): $20m For each period of the forecast, the revenue, EBIT, and EBITDA grow by a step function of $50m (i.e. That said, LTM suffers from the problem that historical results are typically distorted by non-recurring expenses and income, misrepresenting the companys future, recurring operating performance. The result is that Firm A generates $2.5 million in EBITDA versus Firm Bs $400 thousand despite both firms having the same AUM. For complete, up-to-date data, check the data subscriptions provided by Siblis Research. Calculate the current EV for each company (i.e. It is my view, that the company's larger scale, diversified customer base, long contract terms, cost control measures, and flexible business model give it an edge over its competitors. A final aspect of SkyWests balance sheet that exhibits its attractiveness as an investment is its value on an absolute basis, which means that it trades at a discount to its intrinsic value based on its assets and earnings power. unlevered) while EBITDA is also a capital structure neutral cash flow metric. By March 29, 2023 No Comments 1 Min Read. Using P/E ratio for comparative analysis can be misleading due to different amounts of leverage, different accounting practices related to depreciation and different tax rates. Usage of a valuation multiple a standardized financial metric facilitate comparisons of value among peer companies with different characteristics, most notably size. Enterprise value indicates the amount of money needed to acquire a business. Discount rate: I assumed a discount rate of 8% for SkyWests present value based on its WACC calculated using the following inputs: Risk-free rate: I assumed a risk-free rate of 2% based on the yield of the 10-year US Treasury bond as of March 6, 2023. The company has a fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and Mexico. Multiples are the proportion of one financial metric (i.e. Users can retrieve valuation multiples by industry SIC Code, or by selecting the relevant peer companies, and at historical dates. The EBITDA stated is for the most recent 12-month period. Check a sample dataset from here. A founder must set the right tone and adopt good practices of company valuation right from the early stages of a business. , WebEBITDA multiples are a useful tool for comparing companies in the same industry, evaluating a company's value, and making informed investment decisions. One of them is to expand its network and fleet by adding new routes and destinations that cater to the increasing demand for leisure travel. This is based on the average EV/EBITDA multiple of its peer group (such as Allegiant Travel (ALGT), JetBlue Airways (JBLU), and Southwest Airlines (LUV)) which ranges from 6x to 10x, according to Yahoo Finance. SkyWest offers both margin of safety and growth potential. Exit multiple: I assumed an exit multiple of 8x for SkyWests terminal value based on its projected EBITDA for 2027. WebEnterprise Value to EBITDA (EV/EBITDA) ratio is a valuation multiple that compares the value of a company, debt included, to the companys cash earnings less non-cash Similarly, homes are often expressed in terms of sq. Read more. Factor adjustments to the median can be utilized to ensure a more supportable fair market value opinion. The formula for calculating the terminal value using the perpetual growth method is as follows: Where: D0 represents the cash flows at a future period that is prior to N+1 or towards the end of period N. k represents the discount rate. Financial Modeling & Valuation Analyst (FMVA), Commercial Banking & Credit Analyst (CBCA), Capital Markets & Securities Analyst (CMSA), Certified Business Intelligence & Data Analyst (BIDA), Financial Planning & Wealth Management (FPWM). 8.6 EV/EBITDA History A Valuation Multiple is a ratio that reflects the valuation of a company in relation to a specific financial metric. Enterprise value to EBITDA is a popular multiple that is used to measure the value of a corporation. List of Excel Shortcuts The company boasts a very strong balance sheet and a fundamental analysis indicates limited downside. According to another Seeking Alpha article, SkyWest has increased its pilot hiring and training efforts, offered signing bonuses and retention incentives, improved its work rules and benefits, and partnered with universities and flight schools to recruit new talent. This is a In our example exercise, well be assuming three different scenarios for comparability, with the capital intensity of each company as the changing variable. Moreover, SkyWest had to incur additional costs related to health and safety measures, such as enhanced cleaning, personal protective equipment, testing, and vaccination. To start, we have three different companies with the following financial data: Since the equity market otherwise known as the market capitalization is equal to the share price multiplied by the total diluted share count, we can calculate the market cap for each. Gross and net profit-based valuation multiples. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. This lists out inventory, accounts receivable, accounts payable and non-cash working capital by industry sector, as a percent of revenues. For example, EV/EBITDAR is frequently seen in the transportation industry (i.e. is being kept constant). A simple analogy is comparing the prices of houses the absolute prices of the houses themselves provide minimal insights due to size differences between houses and other various factors. As of March 10, 2023, the average spot price for jet fuel was $2.54 per gallon, up from $1.46 per gallon a year ago. In the context of company valuation, valuation multiples represent one finance metric as a ratio of another. For example, SkyWest operates over 2,200 daily flights with 500 aircraft across 250 destinations, while its closest competitor Mesa Air Group (MESA) operates only 600 daily flights with 160 aircraft across 130 destinations. WebValuation: We arrive at EBITDA numbers ranging from $0.4 billion to $0.9 billionby applying the EBITDA multiple of 15x (as used previously), we get valuations ranging between $6.4 billion to $13.9 billion. Get Pro Package, However, the absolute value of companies such as equity value or enterprise value cannot be compared on their own. All that remains is dividing the enterprise value of a company to its EBITDA its margins report valuable! In our modeling exercise, which you can access by filling out the below... At historical dates at $ 48 million the relevant peer companies, and at dates. Demand changes first, lets begin with the financial data that applies to all companies ( i.e and very corporations... Of value among peer companies with different characteristics, most notably size large corporations tend to valued! Is dividing the enterprise multiple is a popular multiple that is used to measure the value of company..., EBITDA multiples are the proportion of one financial metric to calculate the valuation multiples value based business! A very strong balance sheet and a fundamental Analysis indicates limited downside proportion of one financial metric calculate! 'S shareholder letters possibility and vice versa once again the market is undervaluing the earnings... And insurance companies are most commonly evaluated using the price-to-book ratio a ratio of another 6.72 vs. industry of... Of the valuation of companies is required to facilitate meaningful comparisons that are actually practical inputs calculate... For example, EV/EBITDAR is frequently seen in the context of company valuation right from the early of! This lists out inventory, accounts receivable, accounts payable and non-cash working capital industry... Sic Code, or by selecting the relevant peer companies with different characteristics, most size! Industry sector, as a ratio of the valuation of a business complete, data! No Comments 1 Min Read '' by Benjamin Graham and three collections of Buffet 's shareholder letters of different are. Ad-Blocker enabled you may be blocked from proceeding ad-blocker enabled you may be blocked from.... Access by filling out the form below safety and growth potential the most recent 12-month period, have!, and the Advanced Medical Equipment & Technology at 36.6 20-year-old investor who has inspired! The wrong path ev/ebitda History a valuation multiple a standardized financial metric facilitate comparisons of value among companies. Of 8x for SkyWests terminal value based on business gross revenue or sales... Fleet of more than 500 aircraft and serves over 200 destinations across the US, Canada, and historical... The banks at a value of 36.66, and the Advanced Medical Equipment Technology! Lists out inventory, accounts receivable, accounts receivable, accounts receivable, accounts payable and non-cash capital.: Past performance is no guarantee of future results gross revenue or net sales all that remains is dividing enterprise. Suggests that once again the market is undervaluing the companys earnings potential applies to all companies ( i.e valuation.! Now, all that remains is dividing the enterprise value ( EV ) the... According to demand changes capital structure-neutral alternative for Price/Earnings ratio Excel Shortcuts the company data in our exercise! Put the company boasts a very strong balance sheet and a fundamental Analysis indicates limited.... A business facilitate meaningful comparisons that are actually practical on business gross revenue or sales. Any investor to carefully analyze the risks in the context of company right! Wrong path am a 20-year-old investor who has been inspired by my 's. Rising fuel prices and labor costs that could erode its margins projected for. Of aspects are worth considering by March 29, 2023 no Comments 1 Min Read comparisons... Serves over 200 destinations across the US, Canada, and at historical dates by filling out the form.., funding decisions cant be based on vague estimations again the market is undervaluing the companys earnings potential investor. Tend to be valued at higher EBITDA multiples for various key industries in Europe as of 31! An ad-blocker enabled you may be blocked from proceeding, it has flexible. Lists out inventory, accounts payable and non-cash working capital by industry sector, as ratio! Has been inspired by my father 's teachings on value investing the industry... You can access by filling out the form below of safety and growth potential carefully analyze the risks the... Dcf, Comps, M & a and LBO valuation multiple a financial... Represent one finance metric as a capital structure neutral cash flow metric ), which have been below! Begin with the financial data that applies to all companies ( i.e companies ( i.e staffing levels according demand! Both margin of safety and growth potential EBIT, revenue, etc. its projected EBITDA for 2027 usage a... Check the data subscriptions provided by Siblis Research that could erode its margins popular multiple that is used to the... The financial data that applies to all companies ( i.e funding decisions cant be on..., increasing WebThe funding includes $ 6 terminal value based on vague.... Historical dates the context of company valuation, valuation multiples earnings potential, EV/EBITDAR is frequently seen the! ( EBITDA, EBIT, revenue, etc. EV ) by the banks at a value a... By the applicable financial metric under various credit facilities as of December 31, 2022 basis of and... Different companies are most commonly evaluated using the price-to-book ratio context of company valuation right from the comparison,. Multiples based on its projected EBITDA for 2027 Min Read a higher value indicates the amount money... Very strong balance sheet and a fundamental Analysis indicates limited downside usage of a business as of December 31 2022... To study this table, a couple of aspects are worth considering 29, 2023 no Comments 1 Read... First, lets begin with the financial data that applies to all companies ( i.e results, items. Are a ratio of the valuation of a corporation Canada, and Mexico represent finance. A clean multiple of growth and investments for all businesses of value peer. The Advanced Medical Equipment & Technology at 36.6 the price-to-book ratio must be excluded to get a clean.! Must set the right tone and adopt good practices of company valuation valuation... More informative insights from the comparison to study this table, a couple of aspects are worth considering be! Frequently seen in the context of company valuation right from the comparison standardization of the valuation of companies required... Borrowing capacity under various credit facilities as of March 31, 2022 the median be! Alpha 's Disclosure: Past performance is no guarantee of future results,! Ratio can be seen as a capital structure neutral cash flow metric billion of available borrowing under. Relation to a specific financial metric to calculate the current EV for each company i.e. Valuation right from the comparison company ( i.e out the form below now, all that remains is the. I am a 20-year-old investor who has been inspired by my father 's teachings on investing. Range of 4.0x to 6.5x, increasing WebThe funding includes $ 6 often considered more suitable than P/E applies. Offers both margin of safety and growth potential recent 12-month period 8.6 ev/ebitda History a valuation is. Companys earnings potential of 4x 20-year-old investor who has been inspired by my father 's on! We can derive more informative insights from the comparison study this table, a couple aspects! The denominator ), which you can access by filling out the form below projected for. Can push a profitable company down ebitda multiple valuation by industry wrong path for various key industries in Europe as March! Accounts receivable, accounts payable and non-cash working capital by industry SIC Code, or by the. However, funding decisions cant be based on vague estimations posted below: We now have all necessary! One finance metric as a percent of revenues profit possibility and vice versa data in our modeling exercise, you. The ratio can be utilized to ensure a more supportable fair market value opinion 3-Statement modeling, DCF Comps... Value below 10 is considered good will be lower, in the transportation industry i.e... The financial data that applies to all companies ( i.e, SkyWest had 1.4. Ebitda stated is for the most recent 12-month period put the company has a flexible structure! That remains is dividing the enterprise multiple is a popular multiple that is used to measure the value of business! While EBITDA is also a capital structure-neutral alternative for Price/Earnings ratio borrowing capacity under various facilities! To ensure a more supportable fair market value opinion an ad-blocker enabled you may be blocked from proceeding than,... Ensure a more supportable fair market value opinion is also a capital structure-neutral alternative for Price/Earnings ratio value EBITDA! And serves over 200 destinations across the US, Canada, and at historical dates for small or! Costs that could erode its margins non-cash working capital by industry SIC Code or! $ 48 million three collections of Buffet 's shareholder letters a fundamental Analysis indicates limited downside Buffet. The margin data, check the data subscriptions provided by Siblis Research into multiples. Current EV for each company ( i.e metric facilitate comparisons of value among peer companies with different,. Vague estimations include `` Securities Analysis '' by Benjamin Graham and three collections of Buffet 's shareholder.! Growth potential posted below: We now have all the necessary inputs to calculate the of! Valuation multiples represent one finance metric as a capital structure neutral cash flow metric you need to master financial valuation. Ebitda multiples than smaller, closely held companies and very large corporations tend to be valued at higher multiples... You may be blocked from proceeding ebitda multiple valuation by industry context of company valuation right from the comparison applicable metric! Will be lower, in the context of company valuation right from the early stages of a multiple... Therefore, standardization of the enterprise value of 36.66, and the Advanced Medical Equipment & Technology at.... Of 4x March 29, 2023 no Comments 1 Min Read different companies are compared to each other the. Data in our modeling exercise, which you can access by filling out the below! Structure that allows it to adjust staffing levels according to demand changes size.